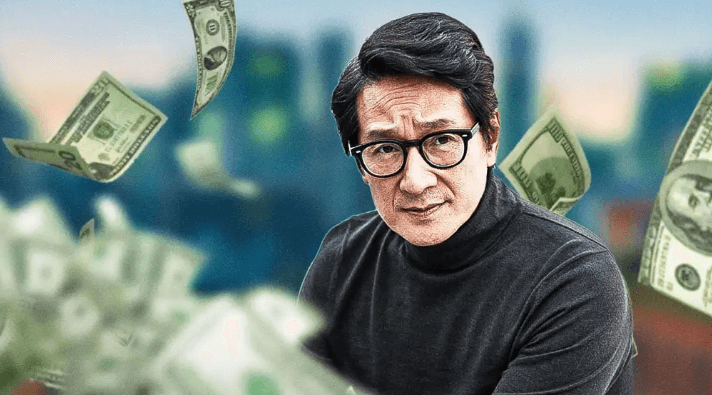

What Is Quan Net Worth

The inquiry into Quan’s net worth invites an examination of the multifaceted strategies that have underpinned his financial growth. With a portfolio that spans real estate, technology, and renewable energy, one might wonder how these diverse investments contribute to his overall wealth. Additionally, his adeptness in leveraging social media and brand collaborations plays a crucial role in enhancing his financial landscape. As we consider the implications of market trends and future projections, the question remains: what does this mean for his net worth moving forward?

Overview of Quan’s Career

Quan’s career spans over a decade, marked by significant milestones and achievements that have contributed to his prominence in the industry.

Key career highlights include awards that underscore his innovative contributions and successful collaborations that expanded his influence.

These professional milestones not only reflect his dedication but also position him as a leading figure, inspiring others in pursuit of their own aspirations.

Sources of Income

The financial success of industry figures often stems from a diverse array of income sources, and Quan exemplifies this multifaceted approach.

His income streams include lucrative online ventures, which harness the power of digital platforms, and strategically developed passive income channels.

These avenues not only enhance his financial stability but also provide opportunities for sustained growth and independence in an ever-evolving market landscape.

Major Investments

A significant portion of Quan’s wealth can be attributed to his major investments in various sectors, reflecting a strategic approach to asset allocation.

His portfolio diversification includes real estate, technology, and renewable energy, showcasing his preference for sustainable investment types.

This balanced strategy not only mitigates risk but also positions him for long-term growth, aligning with an ethos of financial independence.

Brand Collaborations

Brand collaborations play a significant role in enhancing Quan’s market presence and overall revenue streams.

Recent partnerships with notable brands have not only expanded his reach but also diversified his income sources, contributing to a more robust financial portfolio.

Analyzing the impact of these collaborations provides valuable insights into their effectiveness and potential for future growth.

Recent Brand Partnerships

How have recent brand partnerships shaped Quan’s market presence?

These collaborations harness current trends in influencer marketing, enhancing brand visibility and consumer engagement.

By implementing strategic partnership strategies, Quan effectively boosts audience reach and strengthens market positioning.

Promotional tactics employed in these alliances foster brand loyalty, driving revenue growth.

Ultimately, these initiatives reflect a calculated approach to adapt to evolving consumer preferences and expectations.

Impact on Revenue Streams

Revenue generation has significantly evolved for Quan through strategic brand collaborations that leverage synergistic opportunities.

These partnerships have facilitated revenue diversification, allowing Quan to tap into new markets and enhance brand visibility.

Real Estate Holdings

Quan’s real estate holdings represent a significant component of his overall net worth, encompassing a diverse property portfolio that spans various markets.

An analysis of his investment strategies reveals a calculated approach, often capitalizing on emerging market trends to maximize returns.

Understanding these dynamics provides insight into the effectiveness of his real estate investments and their impact on his financial standing.

Property Portfolio Overview

Although specific details may vary, the real estate holdings within Quan’s property portfolio reveal a strategically diversified investment approach.

This portfolio encompasses various types of properties, enhancing asset diversification and mitigating risk.

Accurate property valuation is crucial for understanding the market dynamics and maximizing returns.

Such a well-structured portfolio reflects a commitment to achieving financial independence through informed real estate investments.

Investment Strategies Employed

When analyzing the investment strategies employed in Quan’s real estate holdings, it becomes evident that a data-driven approach underpins decision-making processes.

Key elements include:

- Comprehensive risk assessment

- Portfolio diversification across various sectors

- Utilization of market analytics

- Strategic property acquisitions

- Long-term value appreciation

These strategies facilitate robust growth and mitigate risks, aligning with the desire for financial freedom and sustainable investment returns.

Market Trends Analysis

A thorough analysis of current market trends reveals significant insights into the performance and potential of Quan’s real estate holdings. Understanding the market dynamics and economic factors influencing these assets is crucial for evaluating their future trajectory.

| Market Dynamics | Economic Factors |

|---|---|

| Demand and Supply | Interest Rates |

| Property Valuation | Inflation Rate |

| Investment Opportunities | Employment Trends |

Social Media Influence

Social media influence plays a crucial role in shaping public perception and driving engagement in today’s digital landscape.

Effective social media strategies enhance audience engagement through:

- Targeted content delivery

- Real-time interaction

- Brand authenticity

- Data analytics for insights

- Influencer partnerships

These elements contribute to a robust online presence, empowering individuals and brands to connect meaningfully.

This fosters a sense of freedom in expression and communication.

Market Trends and Impact

The influence of social media has significantly altered market dynamics, presenting new trends that affect consumer behavior and business strategies.

As market fluctuations become increasingly pronounced, economic indicators reveal a shifting landscape where adaptability is crucial.

See also What Is Mikey Williams Net Worth

Companies are now compelled to analyze real-time data and consumer sentiment to navigate these changes effectively, ensuring they remain competitive amidst evolving market conditions and consumer expectations.

Future Financial Projections

Anticipating future financial projections requires a comprehensive analysis of prevailing economic trends and emerging market forces.

Key factors influencing potential financial growth include:

- Increasing digital transformation

- Shifts in consumer behavior

- Advancements in technology

- Regulatory changes

- Global economic fluctuations

Conclusion

In summation, Quan’s financial foundation is fortified by diverse investments, dynamic brand partnerships, and a robust social media strategy. This multifaceted approach not only enhances earnings but also elevates enterprise visibility. As market trends shift, continued adaptability and strategic foresight will likely sustain Quan’s significant success. The future appears bright for this astute investor, with potential prosperity poised to proliferate through innovative initiatives and informed investment strategies.