Key Concepts in Bookkeeping рунпут

Bookkeeping serves as the backbone of financial management, rooted in the principles of double-entry accounting. This method ensures that every transaction impacts at least two accounts, preserving balance and accuracy. However, the significance of meticulous record-keeping extends beyond mere compliance; it informs strategic decision-making. Essential financial statements, such as the balance sheet and income statement, further illuminate a business’s financial health. Yet, the evolving role of technology is reshaping these practices in unexpected ways.

Understanding Double-Entry Accounting

Double-entry accounting is a foundational principle that underpins modern bookkeeping practices, ensuring that every financial transaction is recorded in a systematic and balanced manner.

This method relies on the duality of debits and credits, where each journal entry affects at least two accounts, maintaining equilibrium.

Such a framework empowers businesses to achieve transparency and accuracy in financial reporting, fostering informed decision-making and financial freedom.

The Importance of Accurate Record Keeping

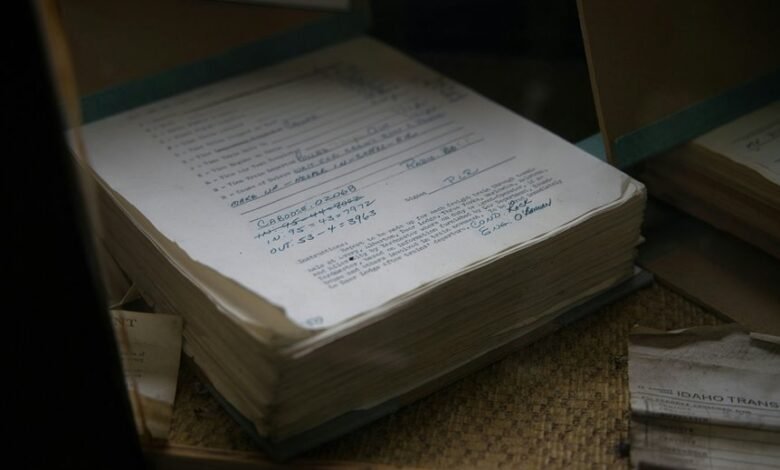

Accurate record keeping is essential for any business, as it serves as the backbone of financial management and reporting.

It ensures financial accuracy, which is vital for informed decision-making. Additionally, meticulous records help businesses adhere to compliance standards, mitigating risks of legal issues and financial discrepancies.

Ultimately, effective record keeping fosters transparency, empowering organizations to operate with greater freedom and confidence.

Key Financial Statements and Their Roles

Financial statements serve as the primary tools for communicating a business’s financial health and performance to stakeholders. They include the balance sheet, income statement, and cash flow statement, each revealing critical insights.

Financial ratios derived from these statements enable stakeholders to assess profitability, liquidity, and overall stability.

Understanding cash flow is essential, as it reflects the company’s ability to sustain operations and growth.

The Role of Technology in Modern Bookkeeping

As businesses increasingly rely on technology to streamline operations, the landscape of bookkeeping has transformed significantly.

Cloud solutions enable real-time access to financial data, fostering collaboration and transparency. Automated processes reduce manual errors and enhance efficiency, allowing accountants to focus on strategic decision-making rather than routine tasks.

This evolution empowers organizations to adapt swiftly to changing economic conditions and optimize their financial management practices.

Conclusion

In conclusion, the intricate dance of double-entry accounting, coupled with meticulous record-keeping, creates a robust framework for financial management. Just as a well-tuned orchestra harmonizes to produce a symphony, accurate financial statements resonate with clarity, guiding informed decisions. The infusion of technology acts as a metronome, enhancing efficiency and ensuring real-time insights. Together, these elements forge a resilient foundation, enabling businesses to navigate the complexities of finance with confidence and precision, akin to a maestro leading a grand performance.