Managing Accounts for Growth With Bookkeeping пфеуюшщ

Effective bookkeeping is a cornerstone for small businesses aiming for growth. Accurate financial records provide essential insights into cash flow and expenses. These insights enable leaders to identify opportunities and address potential risks. By adopting strategic bookkeeping practices and utilizing technology, businesses can enhance their financial management. This foundation prepares them to analyze trends and make informed decisions. However, understanding the nuances of these practices is crucial for sustained success. What elements are often overlooked?

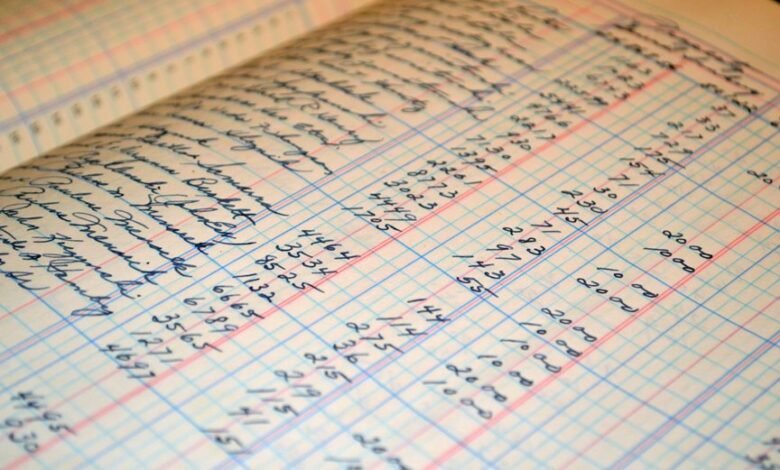

The Importance of Accurate Bookkeeping

Accurate bookkeeping is essential for any organization aiming to achieve sustainable growth. By ensuring financial accuracy, businesses can make informed decisions that drive progress.

The bookkeeping benefits extend beyond mere number-crunching; they foster transparency and accountability, enabling organizations to identify opportunities and mitigate risks.

Ultimately, precise financial records empower leaders to navigate the complexities of growth with confidence and strategic foresight.

Essential Bookkeeping Practices for Small Businesses

Effective bookkeeping practices are vital for small businesses seeking to maintain financial health and support growth.

Key strategies include diligent cash flow management and precise expense tracking. By regularly monitoring cash inflows and outflows, businesses can identify trends, make informed decisions, and allocate resources effectively.

Implementing these practices fosters financial clarity, enabling entrepreneurs to pursue opportunities with confidence and achieve greater autonomy.

Leveraging Technology for Efficient Financial Management

Technology serves as a powerful ally for small businesses aiming to streamline their financial management processes.

By utilizing cloud solutions, companies can access real-time financial data from anywhere, enhancing decision-making capabilities.

Additionally, automation tools reduce manual tasks, minimizing errors and freeing up resources for more strategic initiatives.

This integration of technology fosters efficiency, allowing businesses to focus on growth and innovation.

Analyzing Financial Data for Strategic Decision Making

While many businesses recognize the importance of financial data, the ability to analyze this information effectively can significantly influence strategic decision-making.

Employing financial forecasting alongside data visualization techniques enables organizations to glean insights into trends and patterns.

This analytical approach facilitates informed choices, empowering businesses to navigate complexities and seize opportunities, ultimately fostering growth while maintaining the freedom to adapt to changing market dynamics.

Conclusion

In conclusion, the meticulous management of accounts through accurate bookkeeping is not just a necessity; it is the lifeblood of small businesses poised for growth. By adopting essential practices and leveraging technology, entrepreneurs can transform financial data into a treasure trove of insights. This strategic approach enables them to navigate market complexities with agility, ensuring sustained success. Ultimately, effective bookkeeping is the foundation upon which thriving enterprises build their empires, safeguarding their future against uncertainty.