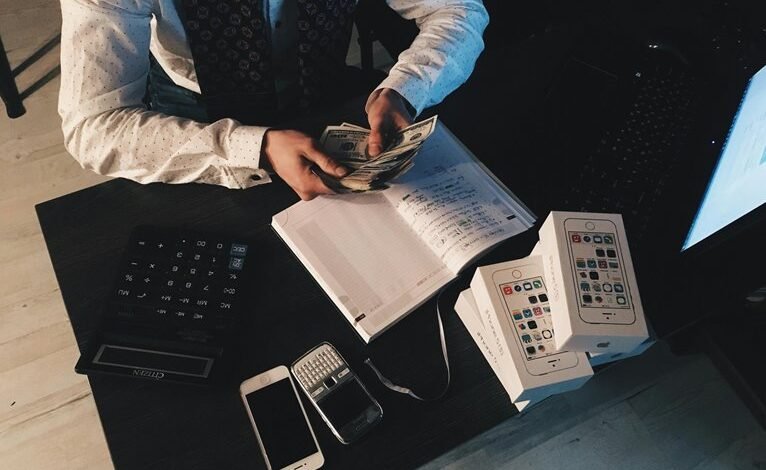

Financial Growth With Bookkeeping дюдхелфж

Financial growth hinges on the fundamentals of bookkeeping. Accurate record-keeping enables businesses to monitor their financial status effectively. By implementing key bookkeeping practices, companies can uncover potential growth avenues. Moreover, analyzing financial data reveals insights that can optimize revenue streams. As organizations enhance their operations through systematic bookkeeping, the question arises: how can they leverage these practices to ensure long-term success in a competitive landscape?

The Importance of Accurate Record-Keeping

Although many businesses overlook the significance of accurate record-keeping, it plays a crucial role in financial growth and sustainability.

Financial accuracy hinges on effective record organization, enabling businesses to track expenses, revenues, and liabilities. This systematic approach not only enhances decision-making but also fosters transparency, ultimately empowering organizations to achieve their goals and maintain financial independence in an ever-changing market landscape.

Key Bookkeeping Practices for Financial Success

Effective bookkeeping practices are essential for businesses aiming to achieve financial success.

Key strategies include meticulous budget management and proactive cash flow monitoring. By maintaining accurate records and regularly reviewing financial statements, businesses can identify trends, control expenses, and optimize revenue.

These practices empower organizations to make informed decisions, ultimately fostering financial stability and growth, while enhancing the freedom to pursue new opportunities.

Analyzing Financial Data for Growth Opportunities

How can businesses leverage financial data to uncover growth opportunities?

By employing financial forecasting and data visualization techniques, organizations can identify trends and patterns essential for informed decision-making.

Analyzing this data allows businesses to recognize potential markets, optimize resource allocation, and enhance profitability.

Ultimately, harnessing these insights equips companies with the knowledge to navigate growth strategies effectively, fostering a culture of financial freedom.

Streamlining Operations Through Effective Bookkeeping

Many businesses find that streamlining operations through effective bookkeeping significantly enhances overall efficiency.

By automating processes, companies reduce manual errors and save time, allowing employees to focus on strategic initiatives.

Additionally, effective expense tracking provides real-time insights into financial health, empowering decision-makers to allocate resources wisely.

This approach not only fosters greater operational freedom but also drives sustainable financial growth.

Conclusion

In conclusion, effective bookkeeping serves as the backbone of financial growth, illuminating the path for businesses to navigate the complexities of their economic landscape. By adhering to accurate record-keeping and employing strategic practices, companies not only safeguard their financial health but also unveil hidden opportunities for expansion. Ultimately, the meticulous management of financial data transforms mere numbers into a compass, guiding organizations toward sustainable success in an ever-evolving market.